How to Assess Adviser Independence for Expats

- Jan 20

- 8 min read

Trying to manage your finances across United States and European borders can quickly become overwhelming, especially when complex tax rules and unfamiliar investment regulations come into play. For American expatriates living in Europe, choosing the right independent financial adviser means understanding your specific cross-border needs and the professional standards advisers must meet. This article offers smart, practical strategies for identifying trustworthy advisers, verifying their regulatory status, and making sense of adviser fee structures so you can protect your wealth with confidence.

Table of Contents

Quick Summary

Key Message | Explanation |

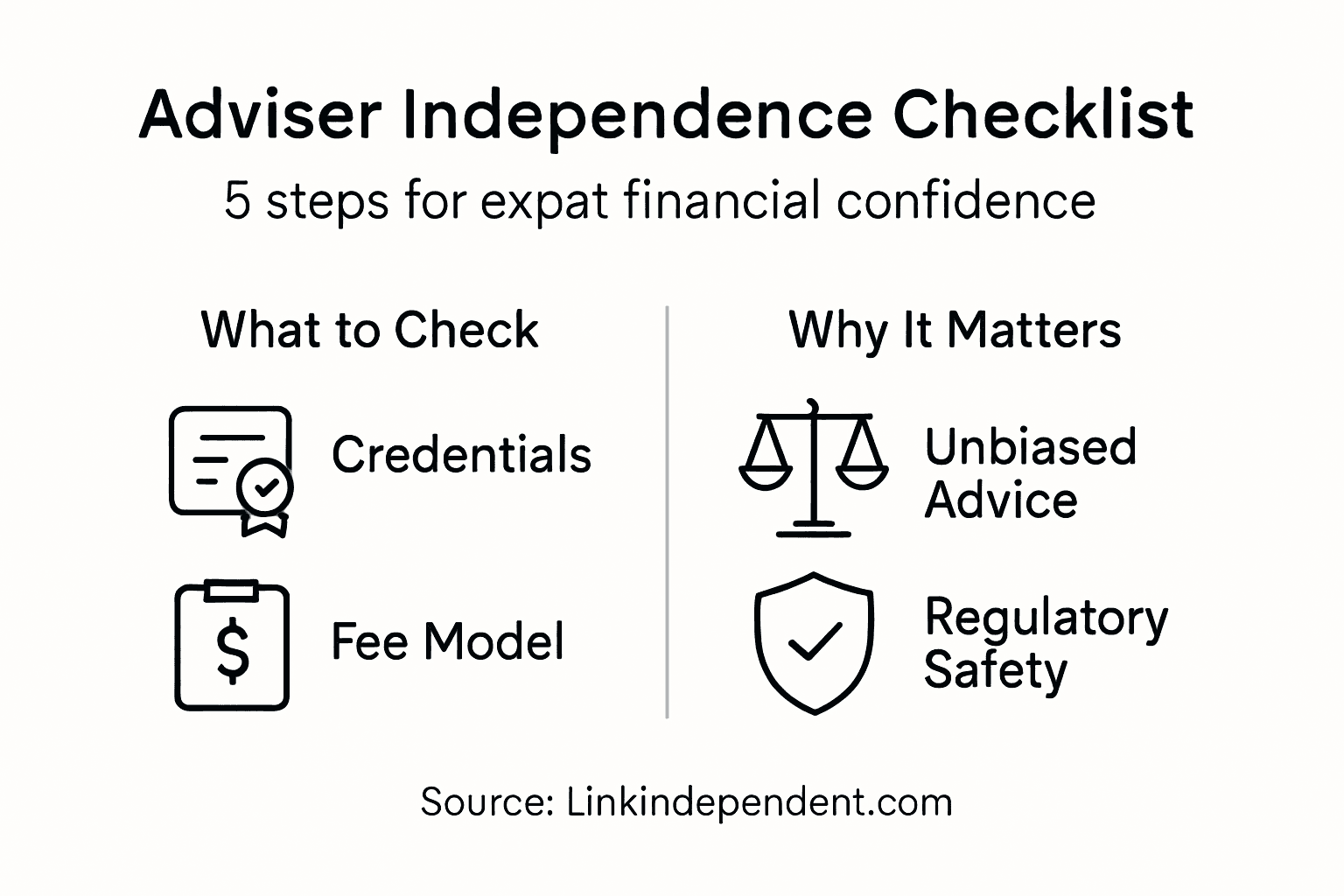

1. Define your financial needs | Assess your current assets and future goals to select the right adviser. |

2. Verify adviser credentials | Ensure the adviser’s qualifications and regulatory status for cross-border advice. |

3. Understand fee structures | Analyse different compensation models to ensure transparency and cost-effectiveness. |

4. Identify potential conflicts | Check for adviser affiliations that might influence their recommendations. |

5. Monitor ongoing compliance | Regularly verify your adviser’s regulatory status and professional standing. |

Step 1: Define your financial needs and cross-border goals

As an American expat, identifying your specific financial needs and cross-border goals forms the critical foundation for selecting an independent financial adviser who can truly support your unique circumstances. This initial step requires thoughtful analysis of your current financial landscape and future aspirations across international boundaries.

Successful financial planning for expats demands a comprehensive understanding of your specific objectives. You will want to map out detailed considerations such as retirement strategies, investment portfolio management, tax efficiency, wealth management options for expats, pension transfers, and potential real estate investments. Consider your timeline for these goals do you need short-term liquidity or long-term wealth accumulation? Are you planning to return to the United States eventually, or establish permanent roots in your new country? Each objective will significantly influence the type of financial adviser you should seek.

Your financial needs assessment should include a thorough inventory of your current assets, anticipated income streams, existing retirement accounts like 401(k)s, and any international investments. Create a detailed spreadsheet or work with a preliminary consultation service that can help you systematically document your financial position. Factor in potential complications such as differing tax regulations, currency exchange risks, and international investment restrictions that could impact your financial strategy.

Top tip: Schedule an initial consultation with a cross-border financial specialist who understands both American and European financial regulations to gain precise insights into your specific expatriate financial planning needs.

Step 2: Identify adviser regulatory status and credentials

Verifying the regulatory status and professional credentials of a financial adviser is crucial for protecting your international financial interests. As an American expat, you need to ensure that your chosen adviser is not only qualified but also legally authorised to provide financial guidance across different jurisdictions.

Start by examining the adviser’s professional certifications and regulatory registrations. Regulatory compliance is fundamental in determining an adviser’s legitimacy and capability to handle cross-border financial planning. The Financial Conduct Authority (FCA) in the United Kingdom provides a comprehensive financial services register where you can verify an adviser’s current authorisation status. Look for specific credentials such as Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), or specialised cross-border financial planning certifications that demonstrate expertise in international wealth management.

Beyond basic credentials, investigate the adviser’s track record with regulatory bodies. Request documentation showing their compliance history, any disciplinary actions, and professional indemnity insurance. Pay particular attention to advisers who understand the nuanced requirements of US expatriate financial regulations, including tax reporting obligations, retirement account management, and international investment strategies. A reputable adviser should be transparent about their qualifications and willingly provide verification of their professional standing.

Top tip: Request and independently verify multiple sources of professional credentials to ensure comprehensive validation of your potential financial adviser’s expertise and regulatory compliance.

Step 3: Evaluate adviser fee structures and compensation

Understanding the fee structures of financial advisers is crucial for American expats seeking transparent and cost-effective financial guidance. Your goal is to comprehend exactly how your potential adviser generates income and how their compensation model might influence the advice you receive.

Financial advisers typically employ various compensation models, and financial advisor compensation trends demonstrate a significant shift towards more transparent fee-based structures. Common models include percentage of assets under management (AUM), hourly rates, flat fees, and subscription-based services. Each approach carries distinct implications for your financial planning. Assets under management fees typically range from 0.5% to 1.5% annually, while hourly rates might vary between £150 to £400 per hour depending on the adviser’s expertise and location. Flat fee structures can provide more predictability, especially for expats with complex cross-border financial needs.

Carefully scrutinise the adviser’s compensation disclosure and ask direct questions about potential conflicts of interest. Fee-only advisers who receive compensation exclusively from client fees rather than commissions often provide more objective guidance. Request a comprehensive breakdown of all potential charges, including transaction fees, advisory fees, and any additional costs associated with specific investment recommendations. A reputable adviser will be transparent about their fee structure and willing to explain how their compensation model aligns with delivering high-quality, independent financial advice.

To help distinguish how different adviser fee models impact expat clients, consider the table below:

Fee Model | How It Works | Typical Range | Key Consideration |

Assets Under Management | Percentage charged on managed assets | 0.5% – 1.5% annually | Scales with portfolio, may add up |

Hourly Rate | Charge per hour of advice | £150 – £400 per hour | Best for limited consultations |

Flat Fee | Fixed charge for defined service | £1,000 – £5,000+ | Predictable cost, suits complexity |

Subscription | Ongoing monthly or annual payment | £100 – £300 per month | Suits regular, ongoing advice |

Top tip: Request a detailed written fee agreement that explicitly outlines all potential charges and compensation methods to avoid unexpected financial surprises.

Step 4: Check adviser affiliations and potential conflicts

Identifying potential conflicts of interest is a critical step for American expats seeking unbiased financial guidance. Your objective is to thoroughly investigate an adviser’s professional affiliations and understand how these connections might influence the recommendations you receive.

Conflicts of interest in financial advising can significantly compromise the quality of financial advice. Advisers may have hidden incentives through institutional partnerships, product commissions, or proprietary investment recommendations that do not align with your best interests. Carefully examine whether the adviser is affiliated with specific financial institutions, insurance companies, or investment product providers. Look for advisers who adhere to fiduciary standards, which legally require them to prioritise your financial welfare above their own potential gains. This means they must provide advice that is genuinely in your best interest, without being swayed by personal or institutional financial motivations.

Request a comprehensive disclosure of all potential conflicts, including any compensation arrangements that might create bias. Pay close attention to advisers who receive trailing commissions, referral fees, or incentives for recommending specific financial products. A transparent adviser will proactively discuss these potential conflicts and explain how they mitigate any risks of compromised advice. Consider requesting written documentation that outlines their approach to managing potential conflicts of interest, and do not hesitate to ask direct questions about their compensation structure and institutional affiliations.

Top tip: Always request a formal conflicts of interest declaration and verify the adviser’s commitment to fiduciary principles before establishing a professional relationship.

Step 5: Verify ongoing regulatory compliance and oversight

Ensuring your financial adviser remains consistently compliant with regulatory standards is essential for protecting your international financial interests. This step involves meticulously investigating the ongoing regulatory oversight and professional accountability of potential advisers.

Global financial regulatory bodies play a critical role in maintaining financial service standards across international jurisdictions. American expats should focus on verifying an adviser’s current registration status with relevant regulatory authorities such as the Financial Conduct Authority (FCA) in the United Kingdom, the Securities and Exchange Commission (SEC), and other international regulatory bodies. Request recent compliance documentation that demonstrates the adviser’s active registration, any professional disciplinary history, and their commitment to maintaining current professional certifications.

Below is a comparison of key global financial regulatory bodies relevant to cross-border advisers:

Regulatory Body | Jurisdiction | Focus Area |

Financial Conduct Authority (FCA) | United Kingdom | Licensing, conduct, consumer safety |

Securities and Exchange Commission (SEC) | United States | Securities regulation, disclosure |

Australian Securities and Investments Commission (ASIC) | Australia | Market integrity, investor protection |

Monetary Authority of Singapore (MAS) | Singapore | Financial sector stability |

Beyond initial verification, establish a system for continuous monitoring of your adviser’s regulatory standing. This involves regularly checking official registries, requesting updated compliance certificates, and staying informed about any changes in their professional status. Pay particular attention to their adherence to cross-border financial regulations, professional conduct standards, and any ongoing professional development requirements. A reputable adviser will welcome your diligence and provide transparent access to their regulatory documentation.

Top tip: Establish an annual review process to independently verify your financial adviser’s current regulatory compliance and professional credentials.

Find Truly Independent Financial Advice Tailored for American Expats

Navigating the complex world of cross-border finances as an American expat is challenging. This article highlights the importance of understanding adviser independence, regulatory compliance, clear fee structures, and fiduciary duty to avoid costly mistakes or biased guidance. You want an expert who not only comprehends US and European financial regulations but also protects your unique goals such as managing 401(k)s, pensions, and international investments with full transparency.

At Linkindependent.com, we specialise in connecting American expats with verified, regulated financial advisers who prioritise your best interests. Our meticulous matching process ensures you engage only with professionals who demonstrate clear compliance, transparent fees, and a proven commitment to unbiased cross-border wealth management.

Don’t leave your financial future to chance. Discover independent, trustworthy financial guidance that truly fits your expatriate needs. Visit Linkindependent.com today to define your financial goals, find your ideal adviser, and schedule a free consultation. Your peace of mind and financial security start with a single step.

Frequently Asked Questions

How do I define my financial needs as an American expat?

To define your financial needs, assess your current financial situation and future goals, including retirement strategies, investment management, and tax efficiency. Map out your objectives in detail, and consider factors like your desired liquidity and whether you plan to return to the United States or settle permanently in your new country.

What credentials should I look for in a financial adviser for expats?

Look for advisers with recognised professional certifications such as Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP), specifically in cross-border financial planning. Verify their credentials through independent sources and ensure they are authorised to provide advice in your jurisdictions.

How can I evaluate the fee structures of potential financial advisers?

Evaluate fee structures by comparing models such as percentage of assets under management, hourly rates, flat fees, and subscription services. Request a detailed breakdown of all charges and consider how each model aligns with your financial planning needs, aiming for transparency in the costs involved.

What should I do if I suspect a financial adviser has conflicts of interest?

If you suspect conflicts of interest, request a comprehensive disclosure from the adviser regarding their affiliations and compensation arrangements. Be sure to ask direct questions about any potential biases, and choose advisers who commit to fiduciary standards prioritising your best interests.

How do I ensure ongoing compliance of my financial adviser?

To ensure ongoing compliance, periodically verify your adviser’s registration status with relevant regulatory authorities and request updated compliance documentation. Establish a regular review process, such as annually, to monitor their regulatory standing and credentials for any changes.

Recommended

Comments