How to Evaluate Wealth Management Options for Expats

- Jan 4

- 7 min read

Most American expatriates relocating to France, Portugal, or Spain underestimate how cross-border tax codes can disrupt wealth planning, with over 60 percent facing unexpected challenges. For anyone moving from the USA, finding tailored solutions that cover both American and British investment and tax regulations is vital. Discover how a simple shift in your financial review process can lay the groundwork for confident wealth management, making European transitions smoother and far less stressful than expected.

Table of Contents

Quick Summary

Essential Insight | Detailed Explanation |

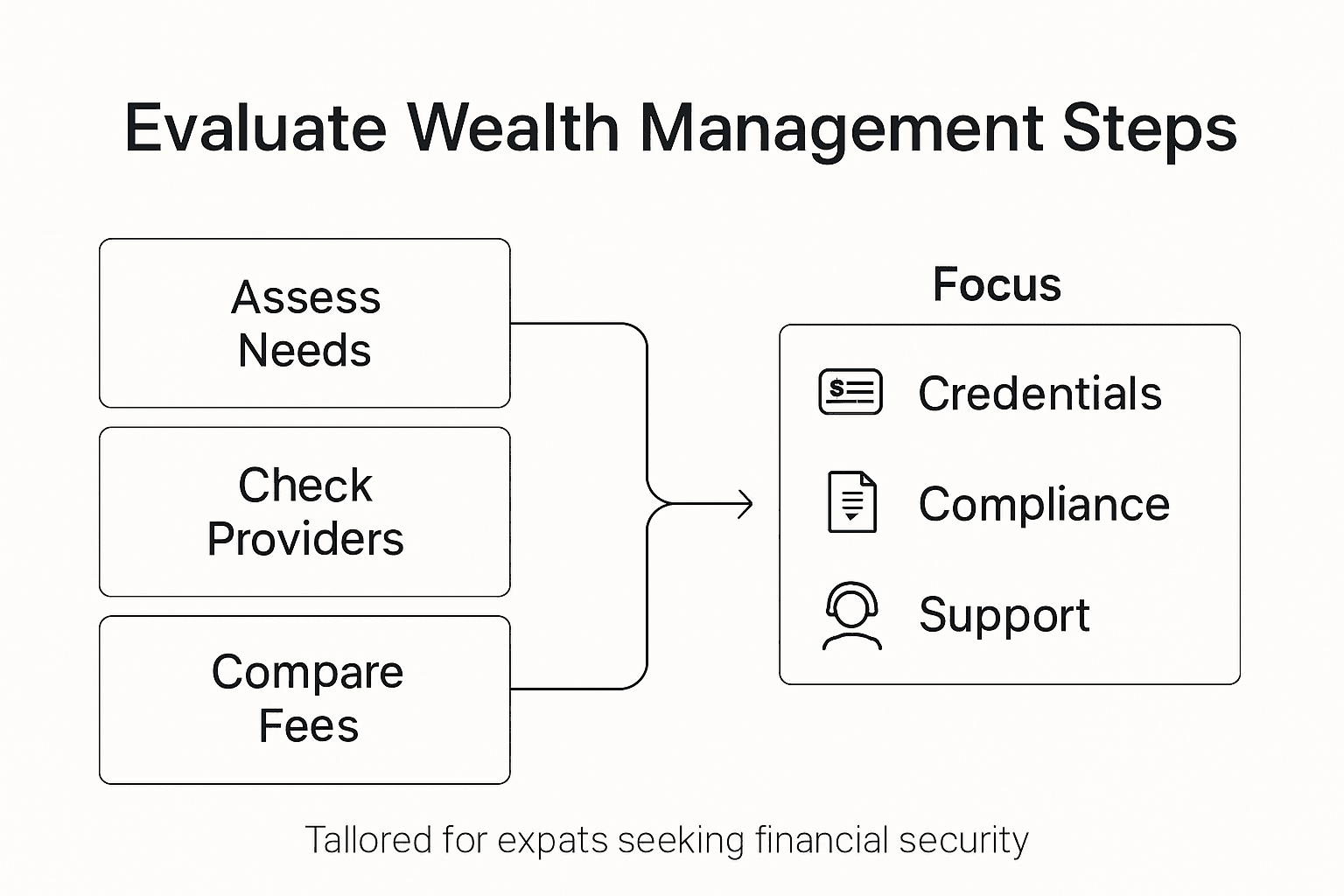

1. Assess Your Financial Needs Early | Conduct a thorough review of your financial situation to identify current assets, liabilities, and future goals before relocating. |

2. Choose Regulated Financial Professionals | Engage with wealth management providers who are registered with recognised regulatory bodies to protect your financial interests. |

3. Understand Fee Structures Clearly | Compare different fee models offered by wealth management providers to find the best fit for your financial needs and long-term goals. |

4. Verify Advisers’ Credentials Thoroughly | Independently check the professional qualifications and regulatory compliance of wealth management advisers before hiring them. |

5. Assess Client Communication Capabilities | Test potential advisers’ communication methods and responsiveness to ensure ongoing support and clarity in your financial management. |

Step 1: Assess your financial needs and relocation goals

Evaluating your financial landscape is crucial when preparing for an international move. Understanding the intricate details of your financial requirements will help you develop a robust strategy for managing wealth across borders. Successful financial planning starts with a comprehensive assessment of your current monetary situation and future objectives.

Begin by conducting a thorough review of your existing financial portfolio. This involves examining your current investment strategies and goals with precision and clarity. Consider key factors such as your income streams, savings, retirement plans, and potential international tax implications. Pay close attention to how your financial assets might be affected by your relocation, including potential changes in taxation, banking regulations, and investment opportunities in your new country.

Next, create a detailed financial checklist that maps out your short term and long term monetary objectives. This should include estimating living expenses in your destination country, understanding local banking requirements, and identifying potential financial challenges unique to expatriate life. Research is critical at this stage work with specialised international financial advisers who understand the complexities of cross border wealth management.

Top Advice: Engage a cross border financial specialist early in your relocation planning to ensure comprehensive and tailored financial guidance.

Step 2: Identify suitable, regulated wealth management providers

Navigating the complex world of international wealth management requires strategic selection of regulated financial professionals who understand the unique challenges faced by expatriates. Your goal is to find providers with comprehensive expertise in cross border financial services and robust regulatory credentials.

Start by investigating registered financial professionals with verifiable credentials who specialise in expatriate wealth management. Look for professionals registered with recognised regulatory bodies like FINRA or SEC, which provide transparent oversight and investor protection. These registered investment advisers must comply with strict licensing requirements and offer a fiduciary duty to protect your financial interests.

When evaluating potential wealth management providers, prioritise those with proven expertise in international financial consulting. Request comprehensive documentation demonstrating their regulatory status, experience with expatriate clients, and specific understanding of your destination country’s financial landscape. Verify their credentials through official regulatory databases and seek recommendations from trusted professional networks specialising in international finance.

Top Advice: Always conduct thorough background checks and request comprehensive documentation before committing to any international wealth management provider.

Step 3: Compare cross-border service offerings and fee structures

Comparing wealth management services requires a methodical approach to understanding the nuanced offerings and pricing models available to international expatriates. Your primary objective is to identify providers that offer comprehensive cross border financial solutions tailored to your specific needs.

Examine cross-border wealth management services with careful consideration of their product access and fee structures. Look for providers that offer a diverse range of services including personalised portfolio management, estate planning, tax strategy, and digital platform capabilities. Pay close attention to different fee models such as asset-based fees, fixed fees, and performance-based compensation structures. Each approach has distinct advantages and potential drawbacks that can significantly impact your long-term financial strategy.

When evaluating potential financial advisers for international clients, request detailed breakdowns of their service offerings and transparent fee schedules. Compare multiple providers side by side, assessing not just the cost but the comprehensive value they provide. Consider factors like regulatory compliance, international investment expertise, and their ability to navigate complex cross-border financial regulations.

Top Advice: Request comprehensive fee structures in writing and compare at least three different wealth management providers before making a final decision.

Here is a summary of common fee structures for cross-border wealth management and their implications:

Fee Structure | How It Works | Potential Benefits | Possible Drawbacks |

Asset-Based Fees | Percentage of assets under management | Aligned interest with client | Can be costly with asset growth |

Fixed Fees | Pre-set flat annual or quarterly fee | Predictable, easy to budget | May not scale with service usage |

Performance-Based Fees | Fee based on meeting specific investment targets | Rewards strong results | May encourage risk-seeking behaviour |

Hourly/Ad Hoc Fees | Charged per consultation or project | Flexibility, pay only when needed | Can be hard to predict total costs |

Step 4: Verify adviser credentials and international compliance

Verifying the credentials and international compliance of your potential wealth management adviser is a critical step in protecting your financial interests as an expatriate. This process requires thorough investigation and systematic verification of professional qualifications and regulatory standing.

Investigate financial professional credentials using authoritative databases that provide comprehensive information about professional certifications, educational requirements, and ongoing compliance standards. Pay special attention to international regulatory bodies such as the European Financial Planning Association, which maintains rigorous standards for cross border financial advisers. Look for advisers who demonstrate commitment to continuous professional development and adhere to strict ethical guidelines.

Utilise multiple verification channels including regulated financial adviser verification resources to cross reference an adviser’s credentials. Request official documentation of their professional qualifications, regulatory registrations, and proof of current licensing. Conduct background checks through official regulatory websites, review their disciplinary history if available, and confirm their expertise in international wealth management for expatriate clients.

Top Advice: Always request and independently verify multiple forms of professional credentials before engaging any international financial adviser.

The following table explains essential credentials and what they indicate about an international wealth adviser:

Credential | What It Demonstrates | Typical Issuing Body |

Chartered Financial Analyst (CFA) | Advanced investment expertise | CFA Institute |

Certified Financial Planner (CFP) | Broad financial planning proficiency | Certified Financial Planner Board |

European Financial Adviser (EFA) | Cross-border financial regulation knowledge | European Financial Planning Association |

Regulatory Registration | Recognised adherence to compliance | FINRA, SEC, FCA, or similar |

Step 5: Test ongoing support and client communication

Effective wealth management for expatriates requires robust and responsive client communication that transcends geographical boundaries. Your goal is to establish a reliable communication framework that ensures transparent and proactive support throughout your international financial journey.

Evaluate the ongoing support capabilities of potential wealth management providers by assessing their communication strategies and client engagement models. Look for providers who offer comprehensive support mechanisms such as regular portfolio reviews, personalised updates, and multiple communication channels including video conferencing, secure messaging platforms, and multilingual support. Prioritise advisers who demonstrate a commitment to continuous client education and adaptable communication strategies that can accommodate your unique expatriate circumstances.

Conduct thorough initial consultations that test the responsiveness and depth of potential adviser communication. Request detailed information about their reporting frequency, preferred communication methods, and protocols for addressing urgent financial queries. Analyse their approach to client support and portfolio management by discussing specific scenarios relevant to your international financial objectives. Seek evidence of their ability to provide proactive advice and transparent reporting that keeps you informed about your wealth management strategies.

Top Advice: Schedule trial communication sessions with potential advisers to directly assess their responsiveness and communication quality before making a final commitment.

Find the Perfect Cross-Border Wealth Adviser for Your Expat Journey

Moving abroad presents complex financial challenges from navigating international tax rules to securing trusted advisers with the right credentials. This article highlights the essential need to assess your financial goals carefully, verify regulated wealth management providers, and ensure transparent fee structures. If you feel overwhelmed by choosing the right cross-border financial professional who truly understands expatriate needs, you are not alone.

At Linkindependent.com, we specialise in connecting expatriates, especially American citizens relocating to Europe and beyond, with verified and regulated financial advisers who can expertly manage investments, pensions, tax planning and more. Our platform offers a clear and independent path through the complexities, ensuring personalised, compliant recommendations that address the exact challenges featured in this comprehensive guide.

Take control of your international finances today by visiting Linkindependent.com. Start your journey with our simple three-step process to define your needs, get matched with experienced cross-border experts, and receive your free consultation. Do not delay securing your financial future in a new country when trusted support is just one click away.

Frequently Asked Questions

How can I assess my financial needs before relocating?

Begin by conducting a thorough review of your existing financial portfolio. Identify your income streams, savings, retirement plans, and potential international tax implications to create a detailed financial checklist of your objectives.

What should I look for in a wealth management provider for expatriates?

Look for providers with verifiable credentials and expertise in expatriate financial services. Ensure they are registered with recognised regulatory bodies and have experience managing cross-border financial challenges.

How can I compare fee structures of wealth management services?

Request detailed breakdowns of service offerings and fee schedules from multiple providers. Compare at least three different providers to understand the implications of asset-based, fixed, and performance-based fees on your financial strategy.

What credentials should I verify for a wealth adviser?

Verify the professional qualifications and regulatory standing of any potential adviser using authoritative databases. Look for certifications such as Chartered Financial Analyst or Certified Financial Planner to ensure they meet rigorous standards for expatriate financial management.

How can I evaluate the communication and support offered by wealth managers?

Schedule trial communication sessions with potential advisers to assess their responsiveness and clarity. Ask about their reporting frequency and methods for addressing urgent financial inquiries to ensure they can effectively support your needs as an expatriate.

Recommended

Comments