Adviser Independence – Safeguarding Expat Finances

- Jan 11

- 7 min read

Most American expatriates discover that choosing the right adviser for cross-border finances can be confusing, especially in France, Spain, or Portugal. With over 80 percent of british financial advisers now offering independent services, there is a growing opportunity for unbiased support in European markets. This guide unpacks the differences between adviser types, helping you make informed choices for wealth management and tax planning that match your international lifestyle.

Table of Contents

Key Takeaways

Point | Details |

Independent Advisers Offer Unbiased Guidance | They provide comprehensive market access and personalised recommendations without being tied to specific product providers. |

Understand Adviser Types | Differentiate between independent and restricted advisers to ensure alignment with your financial goals. |

Verify Adviser Independence | Always request disclosures regarding market access, fee structures, and any potential conflicts of interest. |

Regulatory Compliance is Essential | Ensure your adviser adheres to regulatory standards that protect client interests and promote transparency. |

Defining adviser independence in finance

In the complex world of financial planning, independent financial advisers play a pivotal role in providing unbiased guidance. Unlike traditional financial professionals tied to specific product providers, an independent adviser offers comprehensive, objective recommendations based on a holistic assessment of a client’s financial landscape.

An independent financial adviser represents a professional commitment to client-centric service. These experts analyse the entire market of financial products, ensuring recommendations are driven by individual client needs rather than sales quotas or limited product ranges. Their approach distinguishes them from restricted advisers who may only recommend products from select providers, potentially compromising impartiality.

The core principles of adviser independence centre on transparency, comprehensive market analysis, and client-first strategies. Key characteristics include:

Complete market access across financial products

Fee structures based on service quality, not product commissions

Detailed, personalised financial assessments

Fiduciary responsibility to prioritise client interests

Ongoing financial strategy refinement

Pro-Tip: Always verify an adviser’s independent status by requesting a clear explanation of their market access, fee structure, and potential conflicts of interest.

Types of financial advisers explained

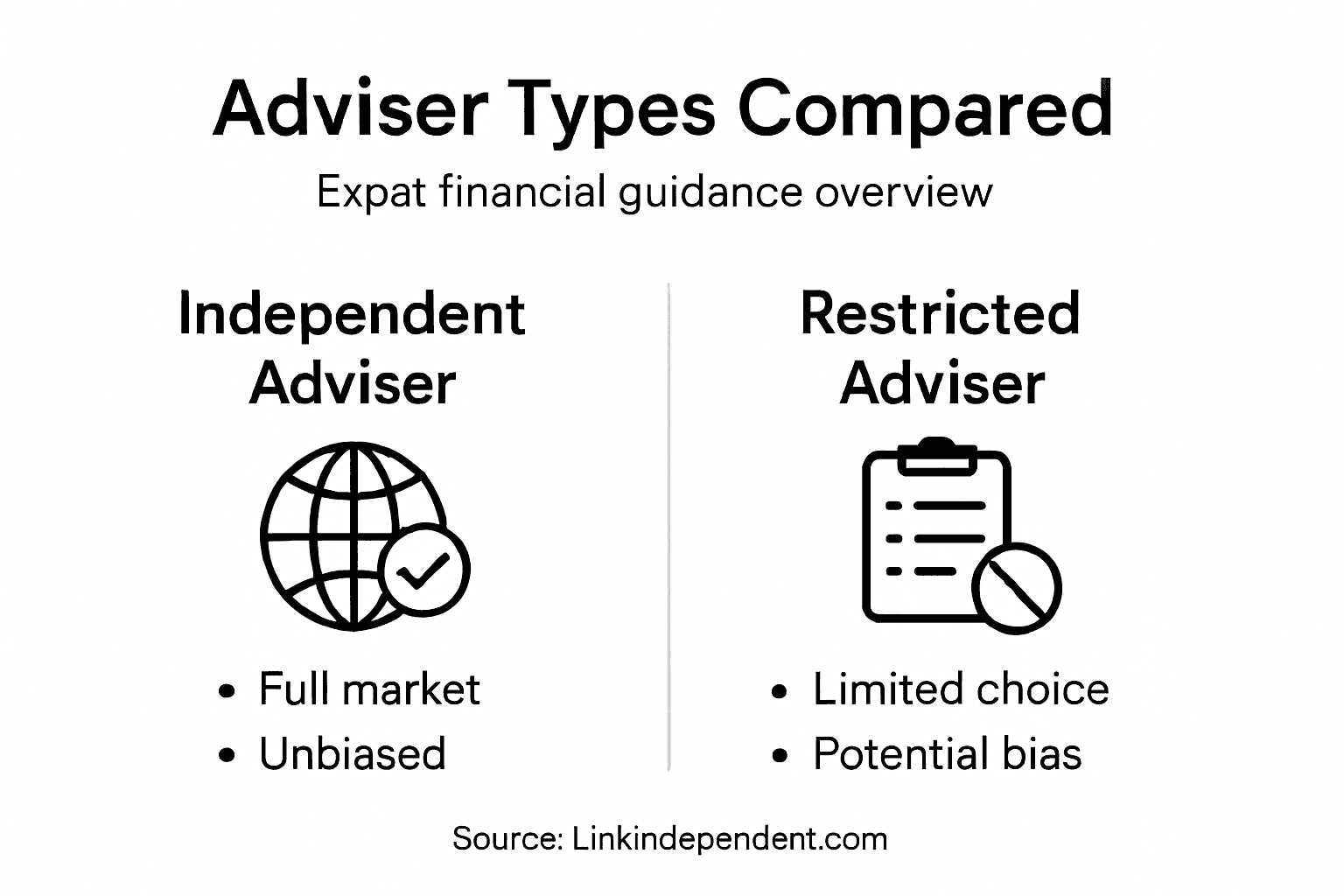

Navigating the world of financial advisory services requires understanding the key distinctions between different types of professionals. Financial advisers are broadly classified into two primary categories: independent and restricted advisers, each with unique characteristics and approaches to providing financial guidance.

Independent advisers offer comprehensive market coverage, analysing products from across the entire financial landscape. They are not constrained by relationships with specific product providers, which allows them to recommend solutions that genuinely match a client’s financial objectives. In contrast, restricted advisers operate with more limited scope, typically recommending products from a predetermined panel or a specific group of financial institutions.

The key differences between these adviser types can be summarised as follows:

Independent Advisers:

Complete market access

Unbiased product recommendations

Comprehensive financial strategy development

Fee structures based on service quality

Fiduciary responsibility to client interests

Restricted Advisers:

Limited product range

Recommendations from specific providers

Potential commission-driven advice

Narrower financial planning perspective

Less flexibility in solution design

Pro tip: Always request a clear disclosure of an adviser’s status and product range before engaging their services to ensure alignment with your financial goals.

Here is a visual summary of how independent and restricted financial advisers differ across several key dimensions:

Dimension | Independent Adviser | Restricted Adviser |

Market Access | Whole market, all products | Selected providers only |

Approach to Recommendations | Client needs prioritised | Limited by provider agreements |

Conflict of Interest Management | Transparent, fee-based | Potential for commission bias |

Customisation Potential | Highly tailored solutions | Standardised options |

Regulatory Compliance | Stringent, comprehensive | Varies by provider |

Core traits of independent advisory

Independent financial advisers distinguish themselves through a commitment to unbiased professional judgment that prioritises client interests above all else. These professionals operate with a fundamental dedication to transparency, autonomy, and client-focused financial guidance that sets them apart from more traditional advisory models.

The core traits of independent advisory encompass several critical principles that ensure high-quality, personalised financial support. These professionals function as autonomous practitioners who are not bound by corporate constraints or product provider influences, allowing them to craft truly customised financial strategies that align precisely with individual client needs.

Key characteristics of independent advisory include:

Professional Independence:

Complete freedom from corporate product pressures

Ability to recommend solutions from across the entire market

No predetermined product affiliations

Transparent fee structures

Direct accountability to clients

Client-Centred Approach:

Comprehensive financial assessments

Tailored investment recommendations

Long-term relationship building

Ongoing financial strategy refinement

Proactive communication and guidance

Fiduciary Responsibilities:

Legal obligation to prioritise client interests

Ethical decision-making frameworks

Full disclosure of potential conflicts

Objective financial advice

Comprehensive risk management

Pro tip: Request a detailed breakdown of an independent adviser’s fee structure, market access, and potential conflicts of interest before establishing a professional relationship.

Regulatory standards and legal frameworks

Financial advisory services operate within complex regulatory environments designed to protect client interests and maintain professional integrity. Legal frameworks establish critical independence requirements that govern how financial professionals conduct their business, ensuring transparency, objectivity, and accountability across international markets.

Regulatory standards emphasise operational, financial, and personal independence for advisers. These comprehensive guidelines prevent undue influences from commercial or political interests, creating robust mechanisms that protect clients from potential conflicts of advice. European Union regulations, in particular, have developed stringent protocols that mandate clear disclosure, ethical conduct, and comprehensive risk management strategies.

Key regulatory principles include:

Operational Independence:

Freedom from external commercial pressures

Clear separation of advisory and product sales functions

Transparent decision-making processes

Documented compliance procedures

Regular independent audits

Legal Safeguards:

Strict conflict of interest disclosure requirements

Mandatory professional liability insurance

Continuous professional development obligations

Regulatory reporting mechanisms

Standardised client protection protocols

Compliance Frameworks:

Adherence to international financial standards

Regular professional certification requirements

Comprehensive record-keeping obligations

Ethical conduct guidelines

Client fund protection mechanisms

Pro tip: Request a detailed compliance certification from your financial adviser, confirming their adherence to current regulatory standards and professional conduct requirements.

Risks, costs and conflicts of interest

Financial advisory relationships carry inherent complexities that require careful navigation, particularly when understanding potential conflicts of financial interests. Expat investors must remain vigilant about how compensation structures and institutional relationships can potentially compromise professional objectivity and recommendation quality.

Conflicts of interest emerge through multiple channels, with the most prevalent being commission-based compensation models that incentivise advisers to recommend specific financial products. These arrangements can create subtle yet significant biases, where financial professionals may prioritise their own financial gain over client outcomes. Independent advisers mitigate these risks by adopting transparent, fee-based structures that directly align their interests with client success.

Key risks and potential conflicts include:

Financial Compensation Risks:

Commission-driven product recommendations

Hidden fee structures

Performance-linked incentives

Institutional kickback arrangements

Undisclosed financial relationships

Operational Conflict Indicators:

Limited product range recommendations

Pressure from product providers

Lack of comprehensive market analysis

Incomplete risk disclosure

Minimal personalisation of financial strategies

Client Protection Strategies:

Request detailed fee breakdowns

Seek fully independent advisers

Demand comprehensive product comparisons

Verify regulatory compliance

Understand adviser compensation models

Pro tip: Insist on a written disclosure of all potential conflicts of interest and ask direct questions about how your adviser is compensated to ensure complete transparency.

For quick reference, here is a table outlining practical steps to verify an adviser’s independence and protect your interests:

Action Step | Why Important | Example Result |

Request disclosure of market access | Confirms adviser neutrality | Adviser can offer entire market |

Review fee structure | Uncovers cost transparency | No third-party commissions |

Ask about conflicts of interest | Ensures unbiased advice | Adviser discloses relationships |

Validate regulatory certifications | Verifies legal compliance | Adviser meets all standards |

Comparing restricted and independent advisers

Understanding the fundamental differences between restricted and independent advisers is crucial for expat investors seeking financial guidance. Regulatory frameworks distinguish these advisory models through their product accessibility, compensation structures, and client recommendation approaches.

Independent advisers operate with comprehensive market access, enabling them to recommend solutions from across the entire financial landscape. They are not bound by institutional affiliations or product provider constraints, which allows for truly personalised financial strategies. Restricted advisers, conversely, function within narrower parameters, typically recommending products from specific providers or predefined panels, potentially limiting the breadth of financial solutions available to clients.

Key comparative aspects include:

Independent Advisers:

Full market product accessibility

Transparent fee-based compensation

Comprehensive financial strategy development

Fiduciary responsibility to clients

Unbiased product recommendations

Restricted Advisers:

Limited product range

Commission-driven recommendations

Potential institutional bias

Narrower financial planning perspective

Constrained solution options

Comparative Decision Factors:

Market coverage

Recommendation objectivity

Fee transparency

Personalisation potential

Compliance with client needs

Pro tip: Always request a detailed explanation of an adviser’s market access, compensation model, and potential conflicts of interest before making a financial commitment.

Secure Truly Independent Financial Advice for Expats Today

Navigating the complexities of cross-border finances demands access to genuinely independent financial advisers who prioritise your unique needs over commission-driven incentives. This article highlights critical challenges such as conflicts of interest, advisor market restrictions, and the need for transparent fee structures — issues that directly impact your wealth planning when relocating or investing abroad. Clients require advisers with full market access and clear fiduciary responsibilities to safeguard their financial future.

At Linkindependent.com, we specialise in connecting expatriates and international investors with verified, regulated financial professionals who embody true independence and transparency. Whether you need help with cross-border taxation, managing pension transfers, or finding the right investment advisers in Europe or beyond, our platform streamlines the process through a personalised three-step approach: define your needs, get matched with trusted experts, and arrange free consultations. Don’t leave your financial security to chance. Discover the peace of mind that comes from working with advisers committed to unbiased, client-first advice today.

Experience the confidence of independent financial guidance tailored for expats. Visit Linkindependent.com now to start your journey towards smarter, transparent cross-border financial planning. Your future deserves nothing less than expert support that puts you first.

Frequently Asked Questions

What is an independent financial adviser?

An independent financial adviser (IFA) provides unbiased financial guidance tailored to a client’s unique needs, ensuring comprehensive market access and product recommendations free from sales quotas.

How do I verify if a financial adviser is truly independent?

To confirm an adviser’s independence, request a clear explanation of their market access, fee structure, and any potential conflicts of interest. This helps establish their commitment to unbiased advice.

What are the benefits of using an independent adviser compared to a restricted adviser?

Independent advisers offer complete market access, personalised recommendations, transparency in fee structures, and a fiduciary responsibility to prioritise client interests, while restricted advisers have limited product ranges and may have commission-driven biases.

What should I consider regarding potential conflicts of interest with financial advisers?

It’s essential to be aware of commission-based compensation models and ask for a written disclosure of any potential conflicts of interest. This ensures transparency and helps protect your financial well-being.

Recommended

Comments