Financial Advisor Verification: Ensuring Trusted Cross-Border Advice

- Jan 2

- 8 min read

Most british and American expats are surprised to learn that more than 40 percent of cross-border investors have fallen victim to unqualified advisers in Europe. Relocating to France, Spain, or Portugal introduces a maze of different regulations, tax laws, and financial standards that quickly overwhelm even savvy professionals. This guide offers a clear look at how financial advisor verification safeguards your investments and explains exactly what to check for when selecting a trusted expert abroad.

Table of Contents

Key Takeaways

Point | Details |

Verification is Essential | Financial advisor verification ensures that professionals meet high standards of competence and ethics, protecting investors from potential risks. |

Importance of Credential Checks | Always request and validate a financial adviser’s professional certifications and regulatory registrations to ensure they are qualified to provide cross-border advice. |

Risks of Unverified Advisors | Engaging unverified advisors can lead to financial mismanagement, fraud, and regulatory complications, significantly jeopardising an investor’s financial security. |

Costs and Compliance | Be aware of the costs associated with verified financial advisors, including compliance fees and ongoing professional development, which influence their service pricing. |

Defining Financial Advisor Verification

Financial advisor verification is a rigorous professional assessment process designed to ensure that financial advisors meet stringent standards of competence, ethical conduct, and regulatory compliance when providing cross-border financial guidance. At its core, this verification process protects investors by confirming that advisors possess the necessary qualifications, skills, and professional integrity to deliver reliable financial advice across international boundaries.

The verification process involves multiple comprehensive evaluations, including detailed examinations of an advisor’s educational credentials, professional certifications, and regulatory compliance. Professional standards set by European authorities mandate thorough checks of an advisor’s knowledge, ongoing professional development, ethical behaviour, and technical competence. These assessments typically include reviewing academic qualifications, professional memberships, language proficiency, and documented evidence of continuous learning and specialised expertise in international financial planning.

Cross-border financial advisor verification becomes particularly complex when professionals seek to provide services across different national jurisdictions. The Dutch regulatory framework exemplifies this complexity, requiring foreign advisors to undergo comprehensive qualification assessments that validate their ability to understand and navigate diverse regulatory environments. This involves not just technical financial knowledge, but also demonstrating proficiency in local legal frameworks, taxation systems, and investment regulations specific to each country where they intend to operate.

Pro tip: When selecting a cross-border financial adviser, always request and independently verify their professional certifications, regulatory registrations, and evidence of continuous professional development to ensure comprehensive protection of your financial interests.

Types Of Verification Across Borders

Cross-border financial advisor verification encompasses several sophisticated mechanisms designed to ensure professional competence and regulatory alignment across different international jurisdictions. These verification processes are critical for maintaining high standards of financial advice and protecting investors when financial professionals operate beyond their home country’s borders.

One primary verification approach involves comprehensive international certification programmes that establish standardised professional benchmarks. The Certified Financial Planner (CFP) certification exemplifies this model, providing a globally recognised framework that validates an advisor’s technical knowledge, ethical standards, and professional capabilities across 28 different territories. These programmes typically require rigorous assessments including:

Extensive professional examinations

Documented academic qualifications

Comprehensive background checks

Proof of continuous professional development

Adherence to strict ethical guidelines

Additionally, cross-border regulatory frameworks mandate specific verification protocols for foreign financial advisors. These protocols often involve complex equivalency assessments, language proficiency testing, and validation of professional credentials. European Union directives, such as Directive 2005/36/EC, facilitate professional mobility while ensuring that advisors meet stringent local regulatory requirements through mechanisms like aptitude testing and supplementary qualification assessments.

Pro tip: When considering a cross-border financial adviser, request documentation of their international certifications and verify their credentials through official professional registration bodies to guarantee comprehensive professional competence.

Regulatory Bodies And Legal Frameworks

Regulatory bodies play a pivotal role in establishing and maintaining professional standards for financial advisors operating across international boundaries. These organisations create comprehensive legal frameworks that ensure financial professionals meet rigorous qualification, ethical, and competence requirements designed to protect investors and maintain market integrity.

The UK Financial Conduct Authority (FCA) represents a prime example of a robust regulatory system that sets stringent professional standards. Their approach involves issuing Statements of Professional Standing (SPS) which serve as critical verification mechanisms. These statements authenticate an advisor’s qualifications, validate their ongoing professional competence, and confirm adherence to strict ethical guidelines. Key elements of such regulatory frameworks typically include:

Mandatory professional qualifications

Regular competence assessments

Continuous professional development requirements

Ethical conduct standards

Transparent disciplinary procedures

Cross-border regulatory frameworks in Europe demonstrate remarkable complexity, particularly within the European Union. These systems are designed to facilitate professional mobility while maintaining high standards of consumer protection. European directives like Directive 2005/36/EC create intricate mechanisms for recognising professional qualifications across different national jurisdictions. Financial advisors must navigate these frameworks, which often require additional certifications, language proficiency assessments, and comprehensive background checks to ensure they can provide reliable advice across varied regulatory environments.

Below is a summary comparing key regulatory bodies governing financial advisers across select European countries:

Country | Regulatory Authority | Primary Role | Verification Requirement |

United Kingdom | Financial Conduct Authority (FCA) | Oversees financial services and markets | Statements of Professional Standing (SPS) |

Netherlands | Dutch Authority for the Financial Markets (AFM) | Regulates financial advice, market integrity | Qualification and equivalency assessments |

Germany | Federal Financial Supervisory Authority (BaFin) | Supervises financial institutions | Registration and compliance checks |

France | Autorité des Marchés Financiers (AMF) | Protects investors, financial integrity | Certified competence and ethical verification |

Pro tip: Always verify a financial adviser’s regulatory registration and check their current standing with the relevant national financial conduct authority before engaging their services.

Key Criteria Used For Adviser Verification

Financial advisor verification involves a comprehensive assessment of professional capabilities, ethical standards, and regulatory compliance. These stringent criteria serve as critical safeguards to protect investors and maintain the highest levels of professional integrity in cross-border financial advisory services.

The Financial Conduct Authority (FCA) establishes rigorous verification standards that encompass multiple dimensions of professional competence. Key verification criteria typically include:

Academic Qualifications: Verified accredited financial planning and investment management degrees

Professional Certifications: Recognised industry-specific credentials

Ethical Conduct: Annual Statements of Professional Standing

Ongoing Competence: Mandatory continuous professional development

Regulatory Compliance: Adherence to current financial advisory regulations

These comprehensive criteria ensure that financial advisors possess not just technical knowledge, but also demonstrate consistent professional behaviour and commitment to client protection. The verification process goes beyond simple credential checking, involving thorough assessments of an advisor’s ability to provide sound, ethical financial guidance across complex international regulatory landscapes. This multifaceted approach requires advisors to prove their capability through documented evidence of professional expertise, ethical conduct, and ongoing learning.

Pro tip: Request a detailed breakdown of a financial adviser’s professional credentials and verify their current regulatory standing to ensure comprehensive protection of your financial interests.

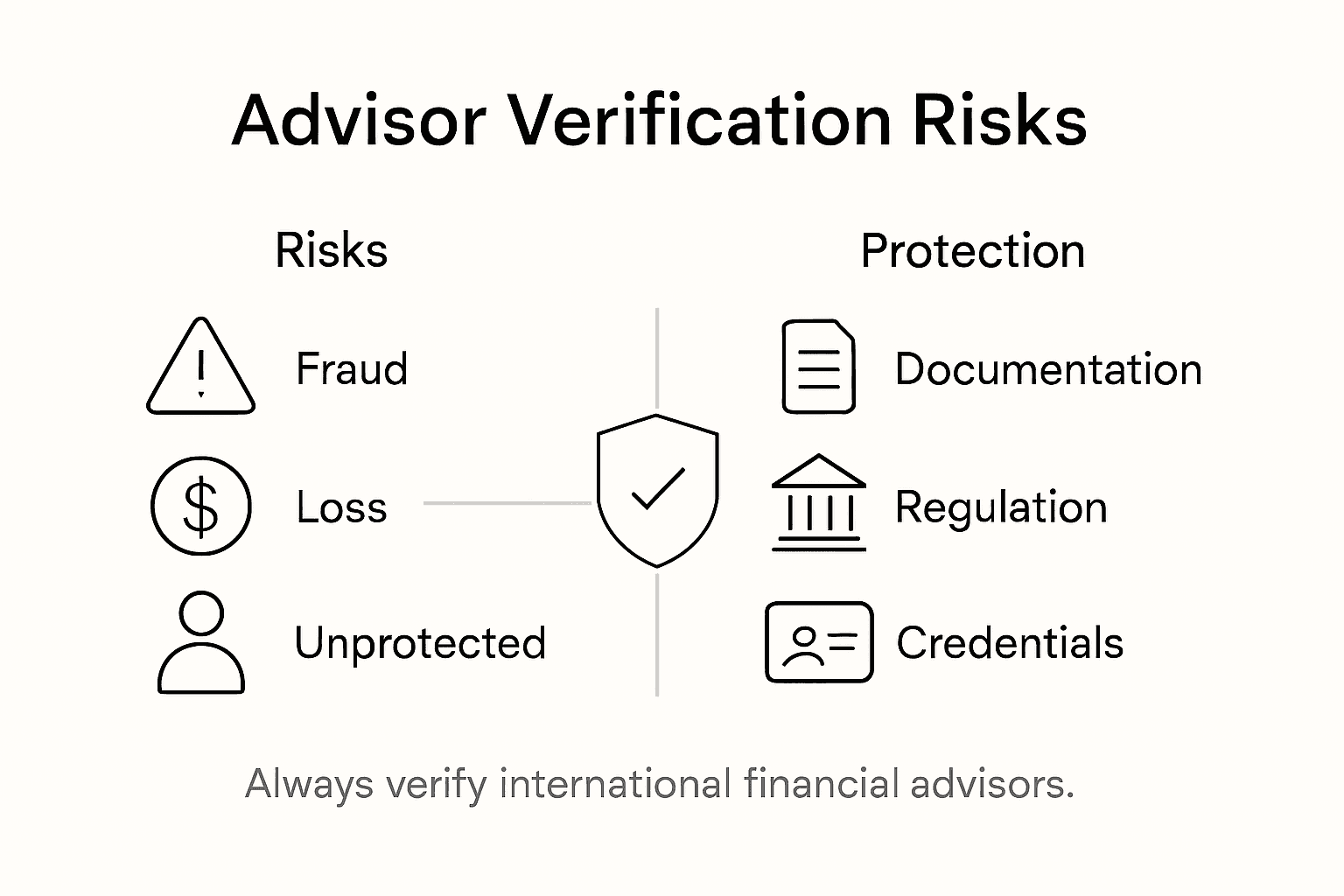

Risks Of Unverified Financial Advisors

Engaging with unverified financial advisors introduces substantial risks that can potentially compromise an individual’s financial security and long-term wealth management strategy. These risks extend far beyond simple monetary loss, encompassing complex challenges that can significantly impact an investor’s financial wellbeing.

Principal-agent conflicts represent a critical risk associated with unverified financial professionals. Such conflicts emerge when an advisor’s personal interests diverge from their client’s financial objectives, potentially leading to recommendations that benefit the advisor rather than the investor. Unregulated advisors may prioritise their own commissions or financial gains over providing genuinely impartial and strategically sound financial guidance.

The potential consequences of working with unverified financial advisors are extensive and potentially devastating:

Financial Mismanagement: Increased likelihood of inappropriate investment strategies

Fraudulent Activities: Higher risk of potential scams and misappropriation of funds

Lack of Legal Recourse: Minimal protection if professional misconduct occurs

Compromised Investment Performance: Suboptimal financial decisions that can erode long-term wealth

Regulatory Non-Compliance: Potential legal complications in cross-border financial transactions

Moreover, unverified advisors often operate without the robust oversight and accountability mechanisms that regulated professionals must adhere to. This absence of external scrutiny creates an environment where financial malpractice can flourish unchecked, leaving investors vulnerable to significant financial risks and potential reputational damage.

Pro tip: Always demand comprehensive documentation of a financial adviser’s professional credentials and verify their regulatory status before entrusting them with your financial planning and investment decisions.

Costs, Compliance And Alternative Options

Navigating the complex landscape of cross-border financial advisory services requires a nuanced understanding of costs, compliance requirements, and strategic alternatives. Financial professionals operating internationally must carefully balance regulatory adherence, professional fees, and client value proposition to maintain competitive and trustworthy services.

The cost structure for verified financial advisors typically encompasses multiple components that reflect the complexity of cross-border financial management. Professional fees are influenced by several critical factors:

Certification Maintenance Costs: Annual professional registration expenses

Regulatory Compliance Fees: Expenses associated with maintaining international professional standards

Specialisation Premiums: Additional charges for cross-border expertise

Ongoing Professional Development: Investment in continuous learning and qualification updates

Insurance and Liability Coverage: Professional indemnity protection costs

Alternative options for individuals seeking financial guidance include digital platforms, robo-advisors, and hybrid advisory models that blend technological efficiency with human expertise. Regulatory frameworks increasingly recognise these emerging advisory approaches, encouraging innovation while maintaining robust consumer protection mechanisms. These alternatives often provide more cost-effective solutions, particularly for investors with straightforward financial portfolios or those comfortable with technology-driven investment strategies.

The table below summarises alternative financial advisory models and their main characteristics:

Advisory Model | Technological Involvement | Cost Implications | Typical User Needs |

Traditional Advisor | Minimal technology use | Highest fees, tailored service | Complex, high-value portfolios |

Robo-Advisor | Fully automated systems | Lowest fees, automated allocation | Simple, tech-savvy investors |

Hybrid Model | Combination of technology and human support | Moderate fees, balanced service | Blend of advice and efficiency |

Pro tip: Evaluate financial advisory services not just by cost, but by the comprehensive value of regulatory compliance, professional expertise, and tailored financial guidance.

Secure Your Financial Future with Verified Cross-Border Advisors

Navigating cross-border financial advice can be complex and risky without proper verification. This article highlights the crucial need for professional credentials, regulatory compliance, and transparent verification to avoid pitfalls like financial mismanagement and fraud. If you are an American citizen planning to move to Europe or seeking trusted advice on taxes, pensions, or investments across borders, finding licensed and verified advisors is essential for peace of mind.

Take control of your international financial planning today with Linkindependent. Our platform specialises in connecting you with regulated financial professionals who meet stringent verification standards, ensuring your interests come first. Start with our simple three-step process to define your needs, get matched with experts, and enjoy free consultations. Don’t compromise on trust — explore how to protect your wealth with confidence by visiting Linkindependent now.

Frequently Asked Questions

What is financial advisor verification?

Financial advisor verification is a process that ensures financial advisors meet high standards of competence, ethical conduct, and regulatory compliance when providing financial guidance across borders. It protects investors by confirming advisors’ qualifications and integrity.

Why is cross-border financial advisor verification important?

Cross-border financial advisor verification is crucial as it ensures that financial professionals can navigate diverse regulatory environments, maintain ethical standards, and deliver sound financial advice that aligns with local laws and practices. This protects investors from potential fraud or mismanagement.

What criteria are used for verifying financial advisors?

Key criteria for verifying financial advisors include academic qualifications, recognised professional certifications, ethical conduct, ongoing competence through continuous professional development, and regulatory compliance with current financial advisory regulations.

What are the risks of working with unverified financial advisors?

Working with unverified financial advisors poses significant risks, including mismanagement of investments, potential fraud, lack of legal recourse, compromised investment performance, and regulatory non-compliance, which can all threaten an investor’s financial security.

Recommended

Comments